Advantages Of Mutual Fund

Professionally Managed

The investments are managed by experienced Fund Managers & qualified research team.

Diversification

Investors can build well diversified portfolio with limited investment. For e.g. investment of Rs 5000 in a Equity fund is diversified among 20-40 or more securities.

Liquidity

Easy to redeem your investment & get back your investment value normally within 3-5 working days. In liquid fund within 24 hours.

Tax Saving & Tax Benefit

Tax can be saved by investing in ELSS scheme (80-C of Income tax Act). Long term Capital Gain Tax in Equity schemes is nil i.e. units held for more than 1 year.

SEBI Governed

AMCs are obliged to make investments in compliance with SEBI regulations. It has mandated strict checks and balances in the structure of mutual funds and their activities.

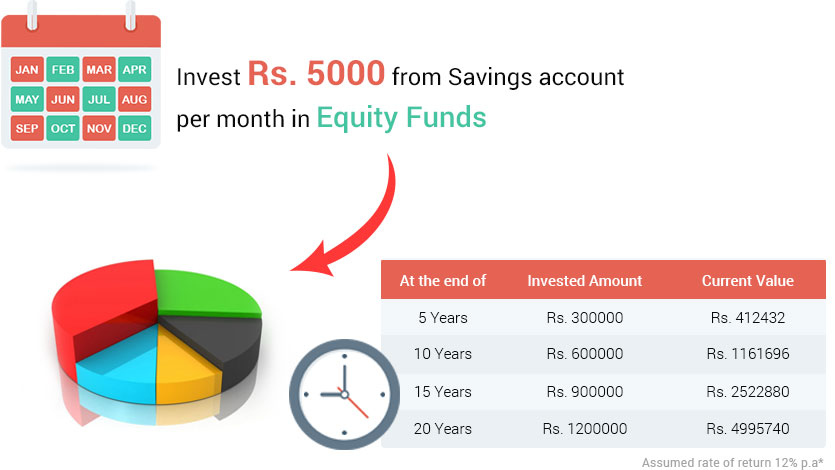

What is Systematic Investment Plan (SIP) ?

A SIP is a tool that help us to invest regularly & in a disciplined manner. The SIP investment can be weekly, fortnightly, monthly, quarterly etc. It’s just like a regular instalment of investments.

You don’t need to give cheque or do electronic transfer every month. It automatically gets deducted from your bank account through auto debit and gets invested in particular Scheme.

SIP= Good EMI

ILLUSTRATION

MR. X started with SIP of Rs 5000 monthly in Equity Scheme of Mutual Fund.

SIP date is 1st of every month.

Expected rate of return is 12% p.a.